Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

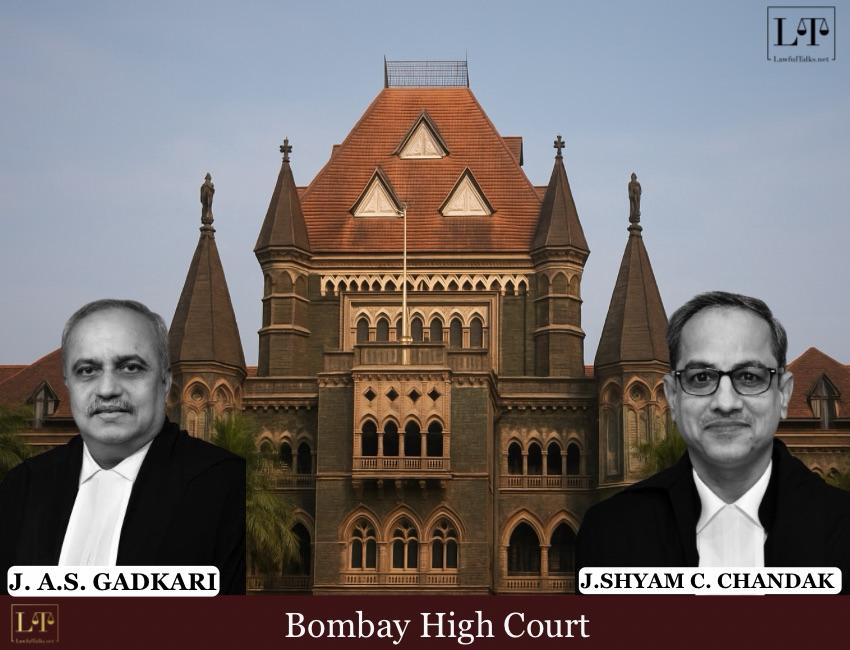

The Bombay High Court division bench of Chief Justice Alok Aradhe and Justice Sandeep Marne has decided the fate of long-pending tax disputes concerning whether sales tax incentives granted by the State Government for setting up industries in specified backward areas should be treated as capital receipts, exempt from tax, or as revenue receipts, liable to income tax.

The controversy arose from two income tax appeals: one filed by the Revenue against Reliance Industries Limited and the other by Bajaj Auto Limited against the Revenue. Both cases pertained to the Maharashtra Government’s incentive schemes framed in 1979 and 1983, respectively, which were aimed at encouraging industries to set up units in backward areas to decongest the Mumbai-Thane-Pune industrial belt.Under these schemes, eligible industrial units were granted sales tax incentives either by way of exemption or deferral of payment, with the stated objective of promoting regional industrialisation.

The core issue was whether such incentives should be treated as capital receipts hereby outside the scope of taxable income or revenue receipts, forming part of taxable profits.

It was the case of the Revenue that the sales tax incentives were linked to the commencement of production and sale of goods. It contended that since the benefits accrued only after production started, they should be treated as operational subsidies to support business profitability and therefore taxed as revenue income.

The Revenue relied heavily on the Supreme Court’s ruling in Sahney Steel & Press Works Ltd. v. CIT,[1997] 228 ITR 253(SC) where subsidies conditional upon production were held to be revenue receipts.

Per Contrary, The assessees, Reliance Industries Limited and Bajaj Auto Limited, contended that the “purpose test” laid down in subsequent decisions by the Supreme Court in CIT v. Ponni Sugars & Chemicals Ltd.[2008] 174 Taxman 87(SC) and CIT v. Chaphalkar Brothers [2018] 400 ITR 279 (SC) should govern. They argued that the dominant purpose of the incentive schemes was to encourage the setting up of industries in backward areas by offering assistance in meeting capital costs, regardless of whether the form of benefit was cash subsidy or tax exemption.

At the outset, the bench observed that the resolution to the issue is the object or purpose for which the subsidy incentive is given would determine the nature of receipt in the hand of the Assessees. The court noted that “the issue is essentially linked to the exact character of the incentive subsidy offered by the State Government, decision of which would be the determinative factor for deciding whether the incentive subsidy is provided to enable the Assessee to set up a new unit or to run the business more profitable. In the former case, the receipt of the subsidy would be on capital account whereas in the latter case, receipt of such subsidy would be on revenue account.”

Upon extensively relying upon Sahney Steel & Press Works Ltd., CIT vs. Ponni Sugars & Chemicals Ltd. and CIT vs. Chaphalkar Brothers the bench narrowed down to the following principles which were deducible:

“(i) While determining the nature of receipt under a particular incentive subsidy scheme, what needs to be applied is “purpose test” i.e. to determine the purpose for which the incentive is offered;

(ii) If the incentive is offered for the purpose of setting up of new industrial unit or for expansion of existing unit, the receipt of incentive would be on account of capital. On the other hand, if the incentive is given for enabling the Assessee to run business more profitably, then the receipt would be on revenue account;

(iii) Since purpose of incentive scheme is the determinative factor, the form or mechanism through which the incentive is actually provided becomes irrelevant;

(iv) Even if actual payment/grant of the incentive is linked to production or sale activity after completion of construction of the industrial unit, the receipt of incentive would still be on capital account so long as purpose of grant of incentive is to promote industrialization.”

Thus, applying the same principles in the present appeals the bench noted that both the 1979 and 1983 schemes were specifically designed to promote new industrial units in backward regions and were linked to the quantum of capital investment.

The fact that the benefit was adjusted against sales tax liability arising post-production did not alter its essential character. The court ultimately held that “In our view therefore, the incentives/subsidy granted by the State Government under both the 1979 as well as 1983 Schemes were for the purpose of setting up of new industrial units. The incentive/subsidy was not granted for the purpose of enabling the Assessees to run the business more profitably. After applying the “purpose test” it is clear that the incentive provided to the Assessee under both the Schemes was for promoting setting up of new industrial units in developing areas of the State. The incentive was aimed at promoting industrialization in the State.”

Accordingly the appeals were disposed of.

Case Title: Bajaj Auto Limited v. Dy. Commissioner of Income Tax.,Income Tax Appeal NO.505 OF 2003

Advocates for Appellant in ITXA/505/2003: Mr. P.J. Pardiwalla, Senior Advocate with Ms. Vasanti Patel

Advocates for Respondent in ITXA/156/2003 & ITXA/505/2003: Mr. Suresh Kumar

Advocates for Respondent in ITXA/156/2003: Mr. J.D. Mistri, Senior Advocate with Mr. Madhur Agarwal, Mr. Fenil Bhatt, Mr. P.C. Tripathi, Mr. Punit J. Shah, Mr. Ketan Dave and Mr. Pratik Shah i/b. M/s. A.S. Dayal and Associates

Akshaj Joshi

Law Student

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 352 Posts

- High Courts 367 Posts