Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

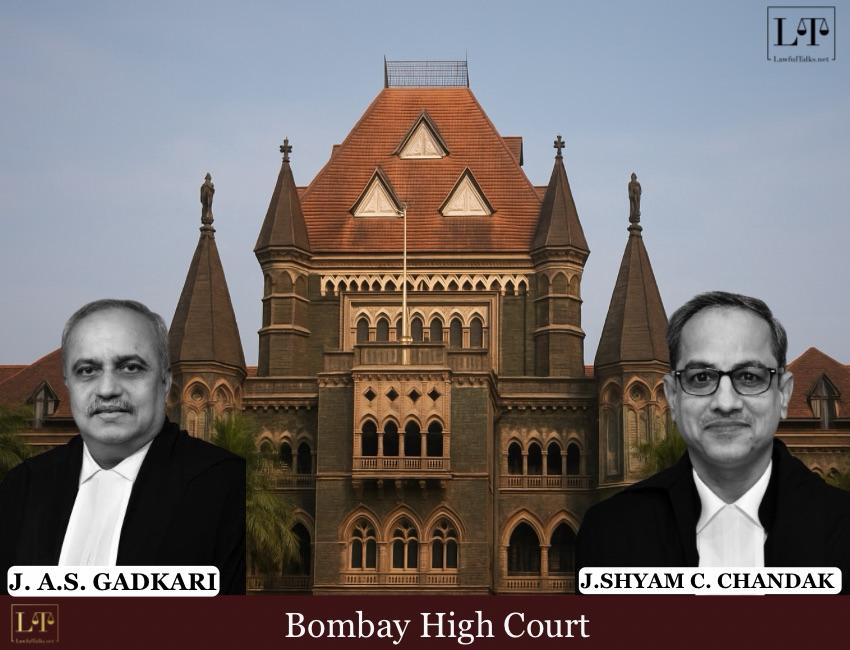

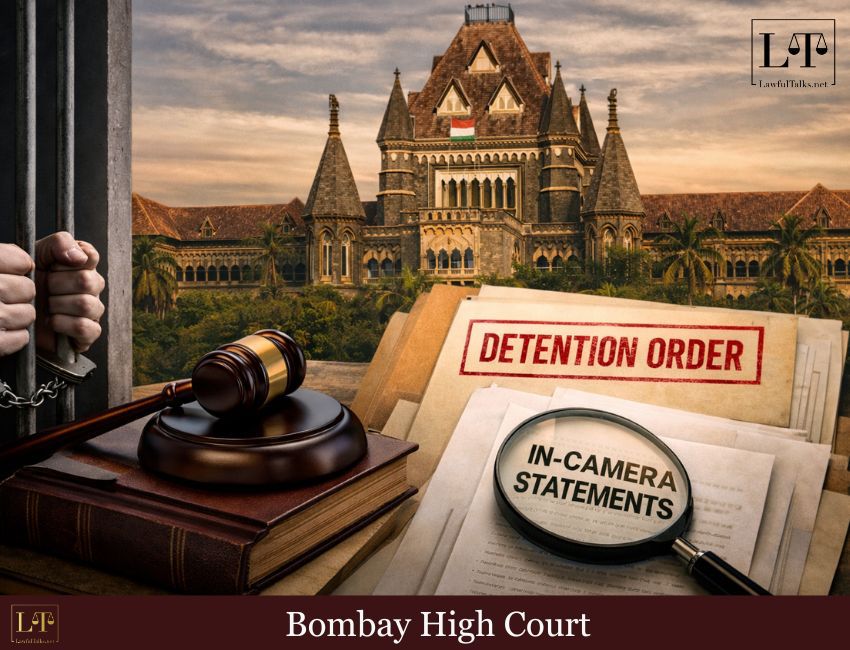

The Supreme Court rapped and overturned a recent order of the Bombay High Court deeming it inappropriate and discerning that, “ a High Court is not the custodian of the revenue’’, it overstepped its bounds acting improperly in granting a stay . Once an appeal is deemed non-maintainable and disposed of, no further stay should be granted emphasized the court.

On 12 June 2025, the High Court had stayed a directive for the refund of Rs 256.45 crore to a firm, even though it had simultaneously held that the revenue authority’s appeal was not legally maintainable. The SC was forced to intervene in the case involving a firm’s petition challenging this ruling. Considering the petition by the firm, the bench of Justices Ujjal Bhuyan and Manmohan emphasized that by staying the order from the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) despite already dismissing the revenue’s appeal, the High Court has overstepped its bounds.

FACTS:

The matter involves a legal dispute between the firm and the Commissioner of CGST and Central excise, Belapur Commiserate. The revenue department had earlier appealed against a January 2025 decision by CESTAT in Mumbai, which had favoured the firm in a service tax dispute. That appeal was filed under Section 35G of the Central Excise Act, 1944.

However, the High Court had recorded in its June 12 order that both the writ petition and the appeal were “disposed of as not pressed,” while also granting liberty to the revenue department to pursue an appeal before the Supreme Court. Yet, it went on to stay the refund direction issued by CESTAT for a period of eight weeks, which the Supreme Court found legally questionable.

The Supreme Court bench also noted that, following the favourable CESTAT ruling, the firm had applied for release of the refund amount, and that request was approved in May 2025. The High Court’s handling was found wanting prompting the Supreme Court to observe that there was prima facie inconsistency in staying a tribunal’s refund order after ruling that the appeal was invalid and after disposing of the matter without pressing it further.

Accordingly, the Supreme Court issued notice to the revenue department, directing it to file its response to the firm’s petition within six weeks. The matter has now been scheduled for further hearing on July 2, 2025.

Pending that, the Supreme Court has put High Court’s June 12 stay order on hold , allowing the refund to proceed for now. However, this temporary relief does not prevent the revenue department from filing a fresh appeal before the Supreme Court under Section 35L of the Central Excise Act,1944 if it has not already done so, clarified the Supreme Court.

Source: News

Shalini Chavan

Advocate, Bombay High Court

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 352 Posts

- High Courts 366 Posts