Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

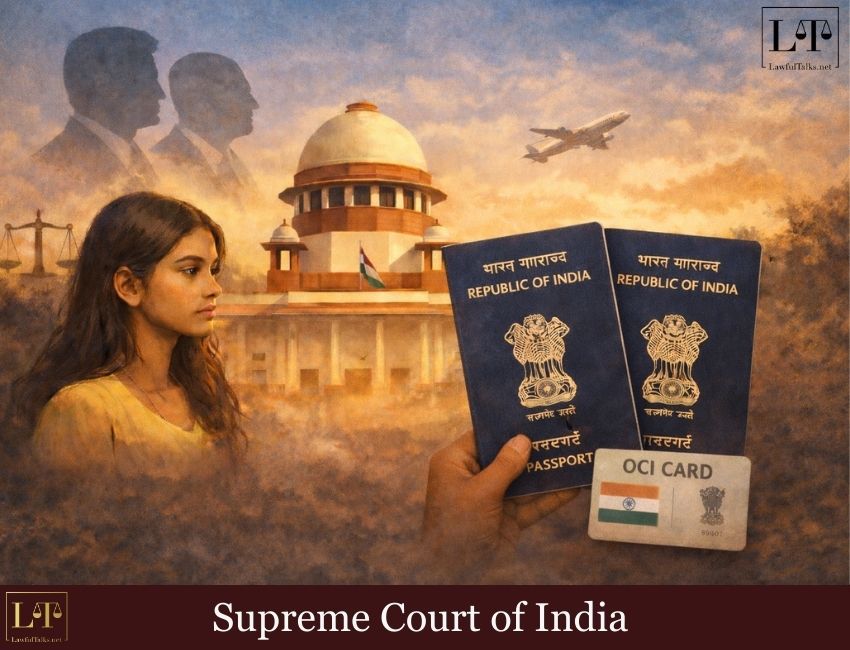

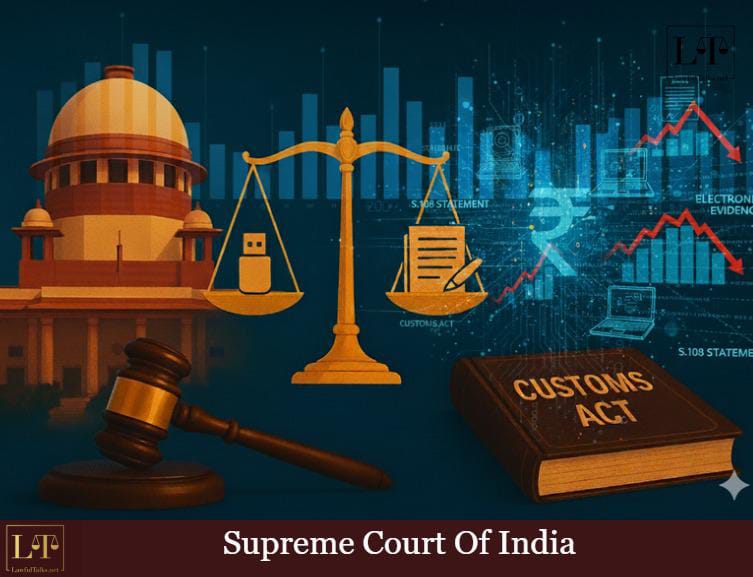

Can electronic evidence be admissible in customs cases without the strict, formal certificate typically required? The Supreme Court’s ruling that addressed this pressing question reflects a pragmatic shift : the court held that an assessee’s own acknowledgment of the evidence can constitute due compliance.

“When we say due compliance, the same should not mean that a particular certificate stricto senso in accordance with Section 138C (4) must necessarily be on record. The various documents on record in the form of record of proceedings and the statements recorded under Section 108 of the Act, 1962 could be said to be due compliance of Section 138C (4) of the Act, 1962.”

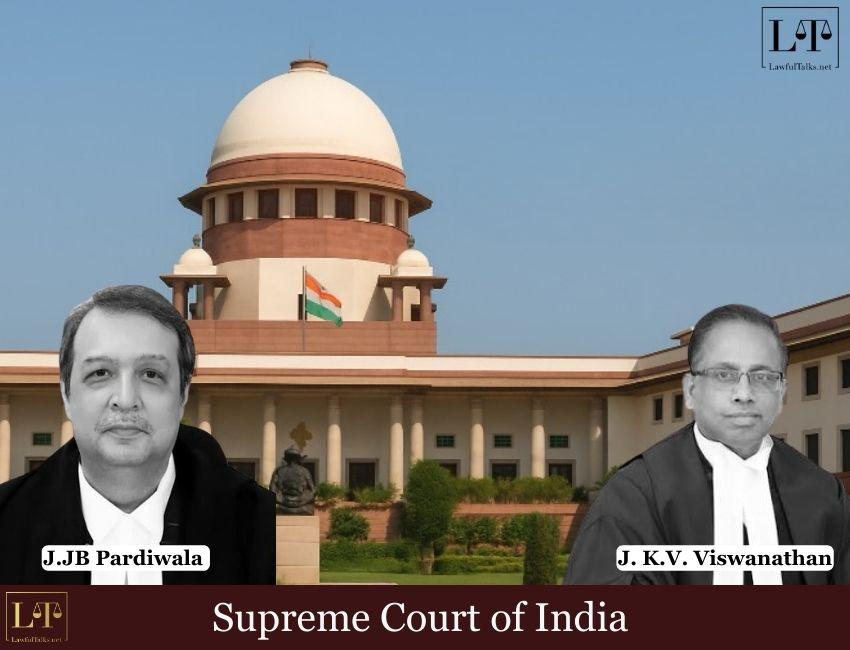

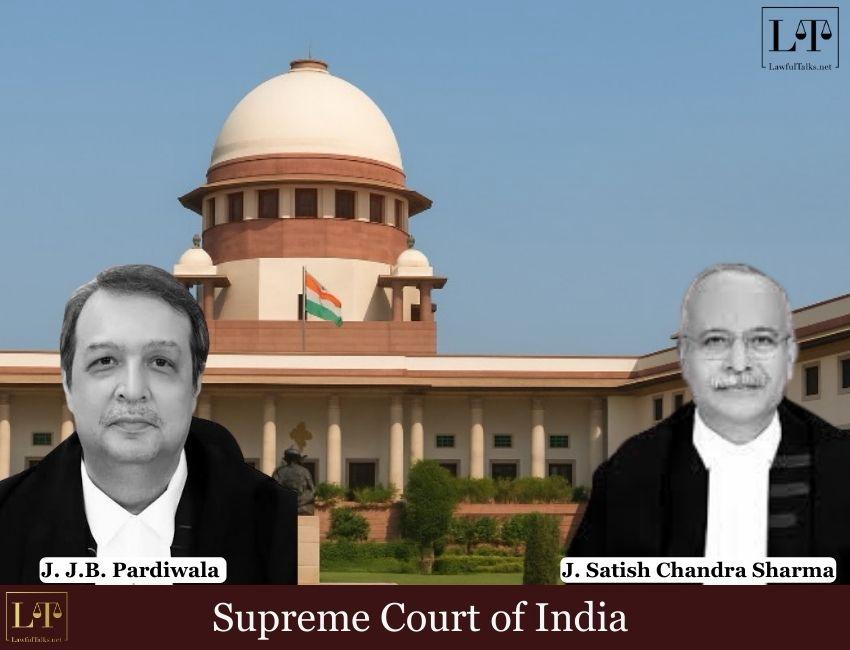

This notable observation was made by the Supreme Court in a recent landmark judgment delivered by a bench of Justice JB Pardiwala and Justice KV Viswanathan.

Background:

The case arose out of proceedings initiated by the Directorate of Revenue Intelligence (DRI) against a company accused of under-declaring the Retail Sale Price (RSP/MRP) of imported branded food items.

The alleged under-declaration resulted in a customs duty evasion of more than ₹9 crores. Central to the DRI’s case was a set of digital records retrieved from laptops and hard drives seized during searches.

The Adjudicating Authority initially upheld the DRI’s claims. However, the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) later quashed the order, ruling that the electronic evidence was inadmissible due to the absence of a Section 138C(4) certificate.

In doing so, the Tribunal relied on the precedent of Anvar P.V. v. P.K. Basheer.

The Supreme Court, however, adopted a different view. It noted that the DRI had carefully documented the seizure and printing process in the presence of the company’s directors.

The directors had signed each page of the printouts and confirmed the accuracy of the records in their unretracted statements under Section 108 of the Customs Act.

The Court held that this amounted to substantial compliance. Relying on the 2020 judgment in Arjun Panditrao Khotkar v. Kailash Kushanrao Gorantyal, it clarified that when the authenticity of evidence is not in dispute particularly when acknowledged by the assessee the absence of a formal certificate does not render the evidence inadmissible.

The Court further explained:

“Even while giving reply to the show cause notice, the contents of such statements recorded under Section 108 of the Act, 1962 were not disputed. This, of course, would be relevant only insofar as determining whether there has been due compliance of Section 138C(4) of the Act, 1962 is concerned. The evidentiary value of such Section 108 statements in any other proceedings, if any would have to be considered in accordance with law, including the compliance of Section 138B of the Act, 1962.”

Ultimately, the Court allowed the appeal, setting aside the Tribunal’s order and remanding the case for rehearing.

The Court directed:

“The judgment and order passed by the Tribunal is hereby set aside. The appeals filed by the assessees before the Tribunal are ordered to be restored to its original file and to be reheard by the Tribunal on grounds other than Section 138C(4) of the Act, 1962.”

Case Title- Additional Director General Adjudication, Directorate of Revenue Intelligence v. Suresh Kumar and Co. Impex Pvt. Ltd. & Ors.

Advocates- Ms. Nisha Bagchi, Sr. Adv. appeared for the Revenue, while Mr. Ashish Batra, Adv. represented the assessees.

Nandani Mishra

Second Year, B.SC LLB, (cybersecurity) Hons, National law University

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 347 Posts

- High Courts 361 Posts