Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

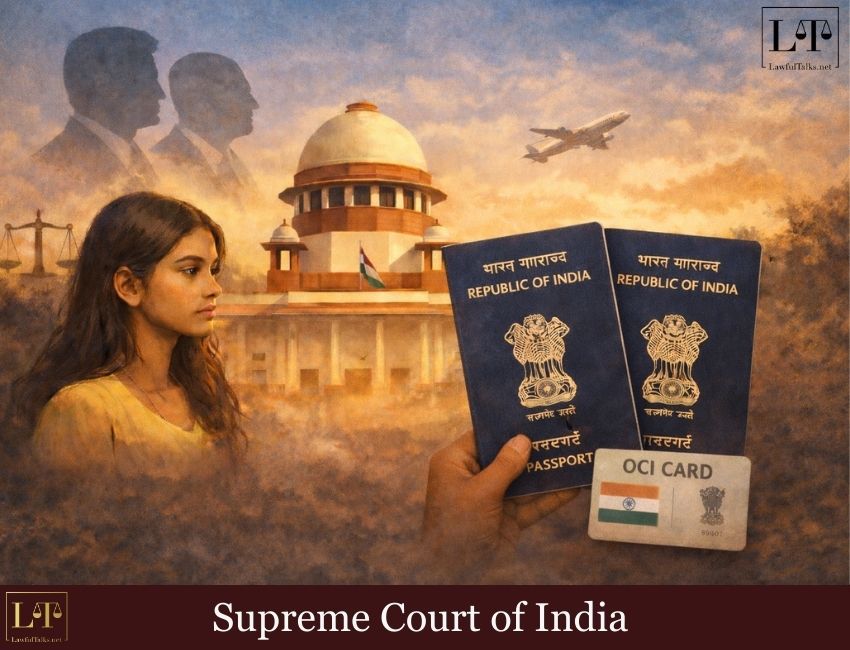

The Supreme Court Bench consisting of Justice JB Pardiwala and Justice R Mahadevan, upheld the acquittal of an Accused, who was convicted under Section 138 of the NI Act. The Court ruled that an authorized signatory of a company cannot be personally liable for a dishonored cheque drawn on the company's account unless the company is named as the principal accused. The bench dismissed claims that the cheque was issued to settle a personal debt, as the accused signed it in his capacity as a director.

The Court explained, “even if the cheque might have been issued for the discharge of personal liability of the accused towards the complainant, had the company Shilabati Hospital Pvt. Ltd. been arraigned as an accused in the complaint case before the Trial Court, it would have remained open to the complainant to establish with the aid of the presumption under Section 139 that the cheque issued by the company was in discharge of a legally enforceable debt. However, in the absence of the drawer of the cheque having been arraigned as an accused, it was rightly held by the High Court that no prosecution could have proceeded against the accused in his personal capacity. The only way by which the accused could be held liable was under Section 141 of the NI Act, however the same could not have been done in the absence of the company being arraigned as an accused.”

The case arose from an alleged loan transaction in 2006, where the complainant (Bijoy Kumar Moni) claimed to have lent Rs. 8,45,000 to the accused (Paresh Manna), Rs. 7,00,000 via a cheque and Rs. 1,45,000 in cash. The accused issued a cheque for the full amount to repay the debt, but the cheque was dishonored due to insufficient funds. The complainant filed a case under Section 138 of the NI Act. The Trial and Sessions Courts convicted the accused, but the High Court acquitted him, ruling that the cheque was issued on behalf of the company, which had not been made a party to the case, rendering the prosecution against the accused unsustainable. The complainant then appealed to the Supreme Court.

The complainant's advocate, Mr. Uddyam Mukherjee, argued that the High Court erred in its acquittal, claiming that the transaction was personal between the complainant and the accused and that there was no evidence linking the company to the cheque. He argued that the cheque, despite bearing the company’s stamp and being signed by the accused as a director, was issued to settle a personal debt. He further contended that the accused had not raised a defense during the Trial Court proceedings that the cheque was issued on behalf of the company and that the accused claimed the cheque was issued as security but misused by the complainant. Mr. Mukherjee urged the Supreme Court to overturn the High Court’s decision.

The accused's advocate, Mr. Gaurav Kejriwal, defended the High Court’s decision, arguing that vicarious liability could not be imposed on the accused without prosecuting the company, as the cheque was drawn on the company’s account and bore its stamp. He emphasized that the complainant failed to issue a statutory notice to the company, the actual drawer of the cheque. The defense consistently maintained that the cheque was issued as security for a loan, not to discharge a legally enforceable debt. Mr. Kejriwal requested the Supreme Court to dismiss the appeal for lack of merit.

After hearing the arguments and reviewing the materials on record, the Supreme Court had to determine:

1. Whether the accused could be considered as maintaining the bank account under Section 138 of the NI Act.

2. Whether a director of a company, acting as an authorized signatory, could be regarded as the drawer of a cheque drawn on the company’s bank account, and thereby said to maintain the account.

The Supreme Court referred to its earlier judgments, in P.J. Agro Tech Ltd. v. Water Base Ltd. (2010) and Jugesh Sehgal v. Shamsher Singh Gogi (2009), where it was consistently held that only the drawer of the cheque is liable for its dishonor under Section 138 of the NI Act. The Court further referred to Shri Gurudatta Sugars Marketing (P) Ltd. v. Prithviraj Sayajirao Deshmukh (2024),where it was ruled that an authorized signatory of a company who signs a dishonored cheque cannot be held liable for interim compensation under Section 143A, applying the doctrine of separate corporate personality. In N. Harihara Krishnan v. J. Thomas (2018),it was reiterated that only the drawer of the cheque is liable for the offense under Section 138, and third parties, such as authorized signatories, are only liable under Section 141 when the drawer is a company. The Court also emphasized that the identity of the drawer must be clear from the cheque, and the complainant cannot implead the company at a later stage.

The Court clarified that under Section 138 of the NI Act, only the account holder could be held liable for a dishonored cheque, not an authorized signatory like a company director. In this case, the accused had signed the cheque as a director of Shilabati Hospital Pvt. Ltd., but the complainant had mistakenly assumed it was from the accused’s personal account. Since the company was not made an accused, the prosecution against the accused could not proceed.

“it is the drawer Company which must be first held to be the principal offender under Section 138 of the NI Act before culpability can be extended, through a deeming fiction, to the other Directors or persons in-charge of and responsible to the Company for the conduct of its business. In the absence of the liability of the drawer Company, there would naturally be no requirement to hold the other persons vicariously liable for the offence committed under Section 138 of the NI Act,” the Court noted.

The Supreme Court also rejected the argument made by the accused who cited the Madras High Court’s judgment in P. Sarvana Kumar v. S.P. Vijaya Kumar(2022), which stated that an authorized signatory of a proprietorship concern could be held liable under Section 138, It emphasized that only the drawer of the cheque can be held liable under Section 138, and Section 141 does not apply to proprietorships, as they do not possess a separate corporate identity. The Court held that Section 138 should be interpreted strictly.

As a result, the Supreme Court rejected the appeal, determining there were no grounds for liability under Section 138, as the cheque was issued from the hospital’s account, not the accused’s personal account. While the Court recognized the complainant’s potential loss from the dishonored cheque and the expiration of the statute of limitations for a civil suit, it permitted the complainant to file an FIR for possible fraud or cheating, given that the accused’s actions raised concerns.

Case Details: Bijoy Kumar Moni Vs. Paresh Manna & Anr. Criminal Appeal No. 5556 of 2024

Advocate for the Petitioner: Mr. Uddyam Mukherjee

Advocate for the Respondent: Mr. Gaurav Kejriwal

Anushka Bandekar

Advocate

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 352 Posts

- High Courts 366 Posts