Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

Calculation of royalties is a policy issue, but the court must not overlook any apparent discrepancies in the calculation method: Supreme Court

The three-judge bench, consisting of former Chief Justice of India, Dr. D.Y. Chandrachud, Justice J.B. Pardiwala, and Justice Manoj Misra, considered the writ petition contesting the validity of Explanation to Rule 38 of the Mineral (Other than Atomic and Hydrocarbons Energy Minerals) Concession Rules, 2016 ("MCR, 2016") and the Explanation to Rule 45(8)(a) of the Mineral Conservation and Development Rules, 2017 ("MCDR, 2017"), which specifies how royalty is calculated for the extraction or consumption of mined ores. The bench stated that while the computation of royalty for various minerals is purely a matter of policy, the Court should not merely disregard the prima-facies anomaly that exists in the very mechanism of average sale price for minerals in terms of the preceding provisions.

As a result, the Court declined to declare the contested provisions to be blatantly arbitrary, given that the Respondents are aware of the anomaly and have already initiated public consultations on the subject. The Respondents are given one final chance to carefully examine the average sale calculation mechanism for calculating the royalty rate for all other minerals in accordance with the Explanations to Rule 38 of the MCR, 2016 and Rule 45(8)(a) of the MCDR, 2017. Additionally, the Court ordered the Respondents to complete the public consultation procedure about the compounding of royalties and make a sound judgement while taking into account the petitioners' arguments in the case at hand.

The Bench observed that the courts must use prudence and caution while considering challenges to the legality of legislation pertaining to economic activity. In such cases, there should be more deference and enough latitude for the executive and legislative branches to handle economic issues.

No one-size-fits-all formula or one-way approach can adequately address complex economic and fiscal issues. Since economic law is an extension of the government's economic strategy, this Court has often acknowledged that a judicially detached approach must be adopted when it comes to it and that the legislature should be given considerable freedom to experiment with it.

Facts of the cases

The government enacted Mineral Concession Rules, 1960 in accordance with Sections 13 and 18 of the Mines and Minerals (Development and Regulation) Act, 1957 (MMDR Act). These rules were later superseded by MCR, 2016 for the purpose of calculating and paying royalties in accordance with Section 9 read with Schedule II of the MMDR Act. The total amount due according to the sale invoice in an arms-length transaction where the price is the only consideration for the sale minus taxes is referred to as the "sale value" under Rule 38 of the MCR, 2016. The rule's explanation further states that royalties, payments, and contributions to DMF and NMET cannot be deducted from the calculation of "Sale Value."

Subsequently, the Central Government, through the 2015 Amendment Act, inter-alia inserted Section 9B and 9C to the MMDR Act, requiring contributions to be made to the National Mineral Exploration Trust ("NMET"), a non-profit autonomous organisation for regional and detailed exploration, and the District Mineral Foundation ("DMF"), a non-profit organisation created to serve the interests and benefits of people and areas impacted by mining-related operations.

Under MCDR, 2017 that was enacted by the Central Government for the conservation and systematic development of minerals, Rule 45(8)(b) provides that the ‘Sale Value’ for the purposes of the said rules is the gross amount payable without any deduction in respect of royalty, DMF and NEMT paid.

In light of the Explanation added to the definition of "Sale Value" in Rule 38 of the MCR, 2016 and Rule 45 (8)(a) of the MCDR, 2017, the petitioners argued that royalty that has already been paid in the previous month is factored further when determining the royalty that must be paid in the following months. As it led to in a cascade effect within the framework of determining the rate of royalty under Section 9(3) of the MMDR Act, the "compounding" of royalty by virtue of the aforementioned explanation is therefore evidently arbitrary.

The petitioners further contended that there is no discernible difference between coal and iron ore for the purposes of calculating royalty, so it is blatantly arbitrary to exclude royalty, DMF, and NMET contributions from the calculation of sale value for coal but not for other minerals like iron. The aforementioned explanation to Rule 38 of the MCR, 2016 and Rule 45(8)(a) of the MCDR, 2017 are therefore in violation of Article 14 of the Constitution and liable to be struck down.

On 25-5-2021, a notice was issued by a committee of the Ministry of Mines inviting suggestions and recommendations from all stakeholders on the issue of double calculation of royalty for computation of the ‘average sale price’, on which a report dated 31-01-2022 was submitted by the committee to the Ministry of Mines.

Subsequently, Ministry of Mines issued a Notice dated 25-05-2022 for public consultation on amending the MMDR Act to bring reforms in the mining sector by inter-alia proposing amendment to the relevant rules for removing the cascading impact of royalty on royalty in the calculation of the ‘average sale price’.

The petitioner claimed that despite the acknowledgment by the Respondents regarding the inclusion of royalty in the calculation of 'average sale price', no changes have been implemented to the MMDR Act and its corresponding rules.

Court’s Assessments

The Court addressing ambiguities in the primary provisions of Rule 38 of the MCR, 2016 and Rule 45(8)(a) of the MCDR, 2017, the court duly noted that they do not surpass the scope of the main provisions or violate the statutory framework. While citing a number of pertinent precedents, that policy decisions belong to the State's executive branch and that courts shouldn't delve into the uncharted territory of public policy, nor should they evaluate the effectiveness of such policies as long as they don't violate any constitutional or statutory provisions.

The Court clarified that although it is possible that royalty was calculated for some minerals without considering the royalty, DMF, and NEMT contributions that had already been paid, this does not imply that the Central Government's authority is limited. The fact that the royalty calculation formula or methodology has changed from the previous MCR, 1960 will not make the new methodology of computing royalty arbitrary.

The Court also stated that the Doctrine of Judicial Restraint stresses the importance of courts being careful and not getting involved in policy decisions, as these require balancing different and often conflicting interests. It is the Court's responsibility to make sure that policies adhere to constitutional and statutory boundaries, although they should only intervene with policymakers' decisions as a last resort.

Applying rules of statutory interpretation, the Court highlighted the importance of interpreting an Explanation to address any ambiguity in the main provision.

The Court also mentioned that not including royalty, DMF, and NMET payments made for coal in the case of other minerals cannot be considered unfair or irrational. Giving one final chance, the Court warned the Respondents that they cannot indefinitely delay a decision on the issue by citing an ongoing public consultation process.

Henceforth, the Court ordered the Respondents a period of 2 months from the date of pronouncement of this judgment to conclude the public consultation process undertaken for amending the MMDR Act and take a final, decisive call regarding the cascading impact of royalty on royalty in the calculation of the 'average sale price' by virtue of the Explanations to Rule 38 of the MCR, 2016 and Rule 45(8)(a) of the MCDR, 2017. The Court also warned the Respondents against further delay, emphasizing that the consultation process should not be used as an excuse to indefinitely postpone the decision.

Case Details- Kirloskar Ferrous Industries Limited V. Union of India Writ Petition (C) No. 715 of 2024

Advocates For Petitioner(s): Dr. A.M. Singhvi, Senior Counsel

Advocates For Respondent(s): Shailesh Madiyal.

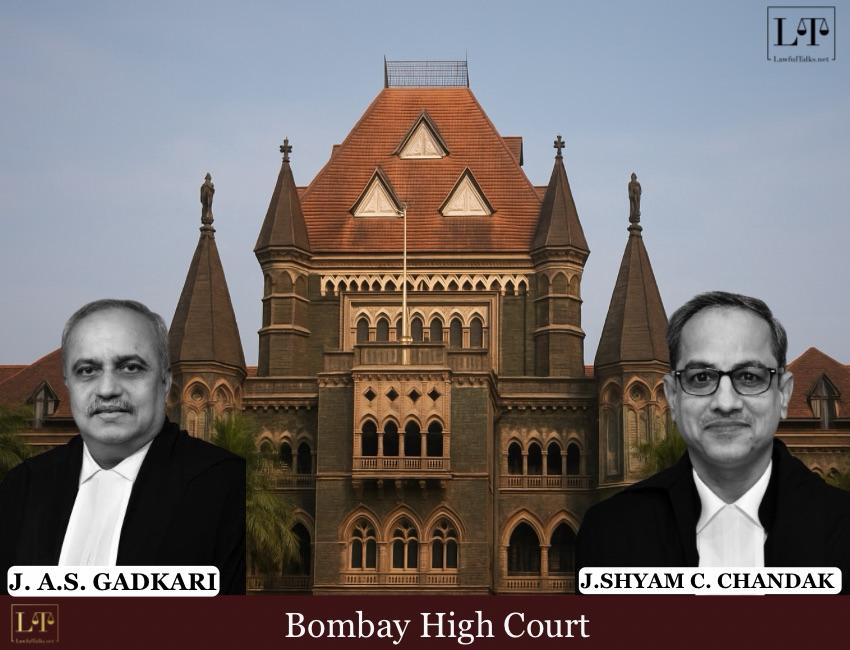

Aishwarya Yashwantrao

Advocate, Bombay High Court

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 352 Posts

- High Courts 366 Posts