Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

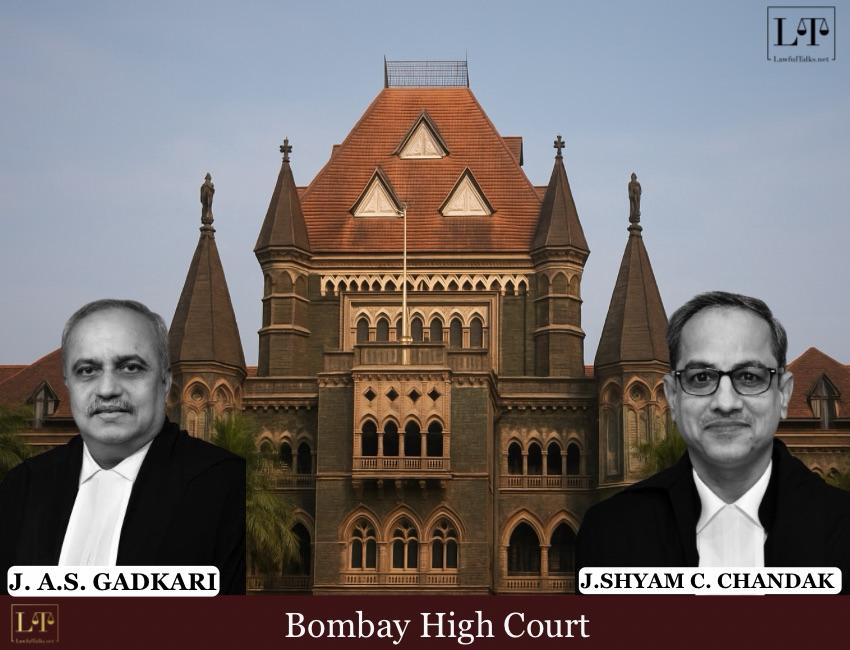

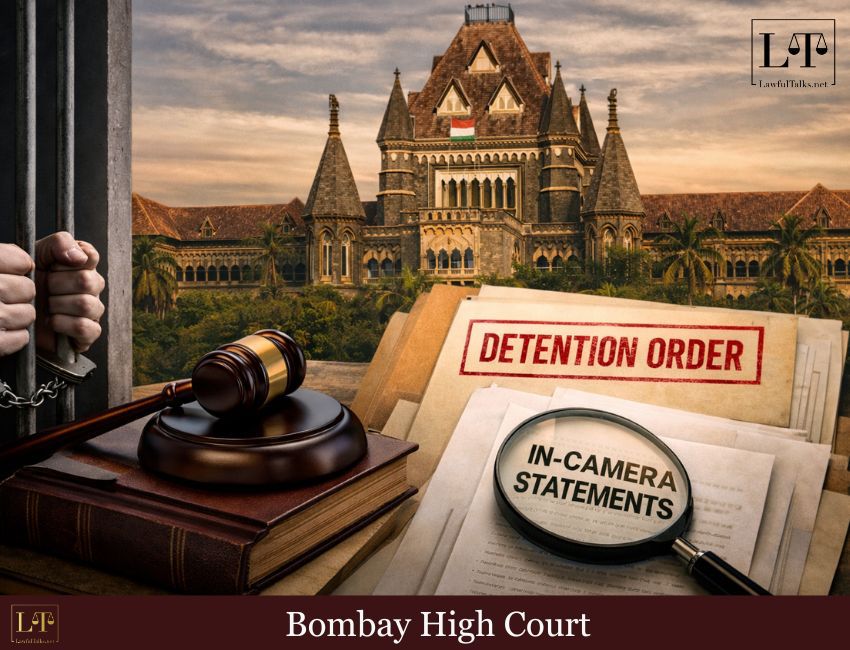

The Bombay High Court Division Bench, comprising Justice K.R. Shriram and Justice Jitendra Jain, on August 26, 2024, dismissed a petition under Article 226 of the Constitution, where the petitioner sought relief from a bank account attachment under the CGST Act. The Respondents alleged fraud, citing inconsistencies and the petitioner's non-genuine business activities. The Court, finding merit in these objections, ordered an investigation and imposed Rs. 5 lakhs in costs on the petitioner.

On September 26, 2023, the court had allowed the Respondents to file a reply within a week. The court noted, on that day, a serious objection by the Respondents, regarding the 'Petitioner invoking the jurisdiction of this Court under Article 226 of the Constitution of India and seeking discretionary reliefs in relation to the attachment notice as issued under Section 83 of the CGST Act'. The Respondents claimed the Petitioner is a bogus person, with Rs. 21 crores deposited in his account, and has not approached the court with clean hands.

The Respondents filed an affidavit on September 29, 2023, stating that a letter was received from the Petitioner, claiming to carry on business of trading in cryptocurrencies, which he argued "did not fall within the purview of GST in any manner." A hearing was scheduled but the Petitioner neither appeared against Summons nor appeared for Personal Hearing.

In the Petitioner's rejoinder, he claimed that he was coerced into signing a statement by GST officers without understanding its contents, under threat of arrest. He denied the contents of the statement and claimed he was harassed during the interrogation.

The court observed that the petitioner claimed to have made a representation on January 17, 2023, objecting to the provisional attachment of their bank account. The respondent countered, stating that the petitioner filed a representation on January 10, 2023, under Section 159(5) of the CGST Rules, 2017, and was summoned to appear on January 30, 2023, with supporting documents. However, the petitioner neither appeared nor submitted any documents, leading to a communication dated February 3, 2023, indicating that no further action would be taken on the representation due to the petitioner's non-appearance. The petitioner did not deny these allegations, leading to the conclusion that he suppressed these facts in the petition.

The court also held that the petitioner claimed that on May 29, 2023, GST officers harassed and coerced him into signing a prepared statement without understanding its contents, under threat of arrest. The court noted that these claims were also not mentioned in the petition affirmed on June 9, 2023, further indicating suppression of facts.

The court noted discrepancies in the petition regarding the petitioner's age, signature, and address. The petitioner's age was inconsistently stated as 22 and 24 years. The petition was signed in Hindi without any endorsement of translation, suggesting the petitioner does not understand English. Furthermore, the petition and affidavit in rejoinder had different signatures, with one in Devanagari script and the other in English.

The court also noted that the address provided in the cause title was found vacant during verification, with the shop vacated in August 2022, as recorded in a Panchnama dated June 1, 2023. These inconsistencies, coupled with the respondent's allegations of the petitioner's non-genuineness, indicated that the petitioner was committing fraud.

The court expressed that this was not a case where it should exercise its jurisdiction under Article 226 of the Constitution of India. Therefore, the Court dismissed the petition. The court directed the authorities to investigate all parties involved in filing the current petition as well as other related petitions, to uncover the truth behind the alleged fraud, and to take necessary legal action, including charges for aiding and abetting forgery and fraud.

The petitioner was ordered to pay Rs. 5 lakhs as costs to respondent no. 2 within 30 days by way of a cheque drawn in favour of the Advocate for respondent no. 2.

Advocate for Petitioner: Mr. Brijesh Pathak

Advocates for Respondents: Mr. Jitendra B. Mishra a/w Ms. Sangeeta Yadav, Mr. Rupesh Dubey and Mr. Ashutosh Mishra

Case Details: Chotu Lal v. Union of India and Ors., WP/8631/2023

Sonam Pandey

Law Student

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 352 Posts

- High Courts 367 Posts