Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

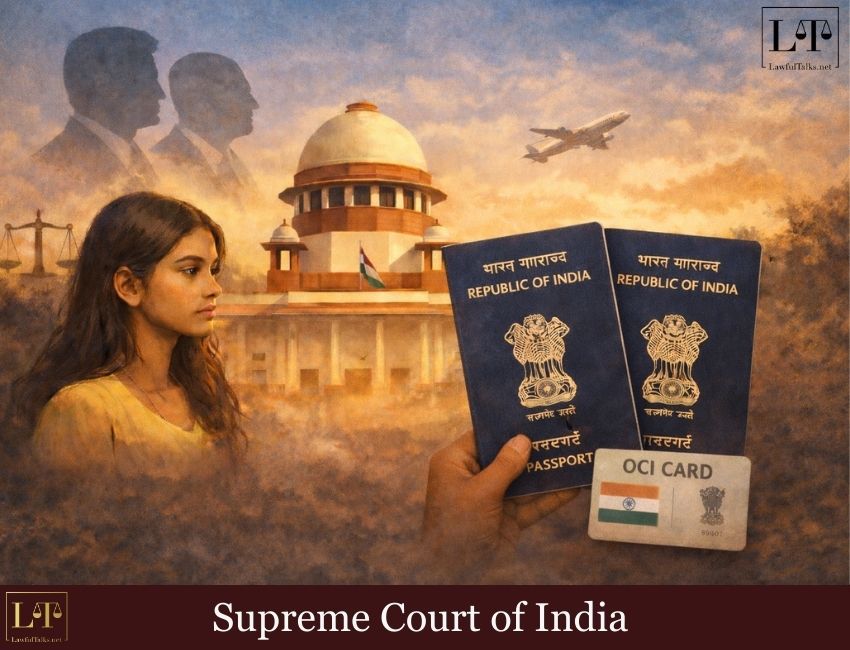

In a significant ruling the Supreme Court has ruled in favour of the State Bank of India (SBI) in a case about the 2020 One-Time Settlement (OTS) Scheme. A bench of Justice Dipankar Datta and Justice A.G. Masih held that a borrower’s application is invalid if the required 5% upfront payment is not made. Because the borrower failed to pay this amount, the Court said the application could not be processed and set aside the Andhra Pradesh High Court’s earlier order to the contrary.

Background:

SBI, a secured creditor under the SARFAESI Act, had extended credit facilities to the respondent against seven mortgaged properties. Following persistent defaults, the account was classified as a non-performing asset (NPA), leading to a demand notice in 2017 and recovery proceedings before the Debt Recovery Tribunal (DRT).

Although a compromise sanction was granted in 2018, the respondent again defaulted. SBI proceeded with recovery measures, including auctioning one property in March 2020. The respondent challenged the process before the DRT, which granted limited interim reliefs.

In October 2020, SBI launched the OTS 2020 Scheme. The respondent applied for settlement but SBI rejected the request, citing non-compliance with prior orders, suppression of facts, and the earlier auction sale. The respondent then moved the High Court, which ruled in its favour, holding that SARFAESI proceedings and auction sales were not a bar to eligibility under the OTS 2020 Scheme. SBI’s intra-court appeal was dismissed by the Division Bench, prompting the present appeal before the Supreme Court.

Appearing for SBI, Additional Solicitor General Mr. Venkatraman argued that the OTS 2020 Scheme could not be enforced under Article 226 unless its terms were strictly satisfied. He stressed that the respondent had a history of defaults, including failure to comply with the 2018 compromise and a 2019 DRT order, and repeatedly dishonoured commitments. He contended that the rejection was valid and the High Court had erred in interfering with SBI’s decision.

Senior lawyer D.S. Naidu argued in support of the High Court’s decision. He said that although a borrower has no automatic right to get benefits under the OTS scheme, the bank must give clear reasons if it rejects an application, and follow the rules of natural justice.

He explained that the High Court had only asked the bank to reconsider the case, not to grant the settlement. Rejecting the request without giving the borrower a fair hearing was, he said, arbitrary. He also noted that earlier property auctions were cancelled and the deposits returned, so no third-party rights were involved, and the borrower had already paid ₹1.5 crore in good faith.

Rejecting the arguments of the respondent, the Supreme Court held that the respondent had failed to comply with the scheme’s express terms.

“Crossing the hurdle of eligibility per se would not entitle a defaulting borrower to claim consideration of his/its application unless the application itself satisfies the other stipulated conditions.” the Court observed.

The Court further emphasized that “It is clear as a sunny day that an application for availing the benefit thereunder would be processed if such application were accompanied by an up-front payment of 5% of the outstanding dues. Indubitably, the respondent faltered in not adhering to the express terms of such scheme by not depositing 5% of the outstanding dues as up-front payment, thereby rendering its application disentitled to be processed even, far less deserving a favourable consideration.”

Justice Datta reiterated that “It is, therefore, clear that every borrower in default, to have his application under the OTS 2020 Scheme considered, was required to apply together with an up-front payment of 5% of the OTS amount. The manner of calculation of the OTS amount was provided in clause 3A (v) of the OTS 2020 Scheme. For wilful defaulters, payment of 15% was required. It has not been argued before us that the respondent falls in the category of a ‘wilful defaulter’; however, it is certainly a defaulter. We did not find the respondent, while applying for the benefit of the OTS 2020 Scheme, to have deposited a single paisa towards up-front payment. In terms of clause 4(i) of the OTS 2020 Scheme, any application received without up-front payment is not required to be processed even. Thus, in the first place, the respondent’s application was incomplete and it did not have any right in law to claim that such application should be processed.”

The Court also noted that in Bijnor Urban Coop. Bank Ltd. v. Meenal Agarwal, it had been held that “the benefit of the OTS cannot be claimed as an absolute right.”

Accordingly, the Supreme court set aside the High Court’s orders, allowing SBI’s appeal. However, to be fair it permitted the respondent to submit a fresh proposal for settlement, though not under the OTS 2020 Scheme.

“The appellants are free to proceed in accordance with law for enforcement of the security interest. At the same time, we also grant the respondent an opportunity to submit a fresh proposal for OTS but not under the OTS 2020 Scheme. If the terms and conditions put forth by the respondent are found reasonable, workable and acceptable, the appellants may take such decision on it as deemed fit and proper in the circumstances.” the Court clarified.

Advocate for the Petitioner: Mr. N Venkataraman, A.S.G. Mr. Sanjay Kapur, AOR Mr. Surya Prakash, Adv. Ms. Shubhra Kapur, Adv. Ms. Mahima Kapur, Adv. Ms. Mansi Kapur, Adv.

Advocate for the Respondent: Mr. Dama Seshadri Naidu, Sr. Adv. Mr. Mullapudi Rambabu, Adv. Mr. Praveen Kumar Sharma, Adv. Ms. Mahima Pandey, Adv. Ms. K.m.s. Sivani, Adv. Ms. D.Poornima, Adv. M/S. M. Rambabu And Co., AOR

Anushka Bandekar

Advocate

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 390 Posts

- High Courts 383 Posts