Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

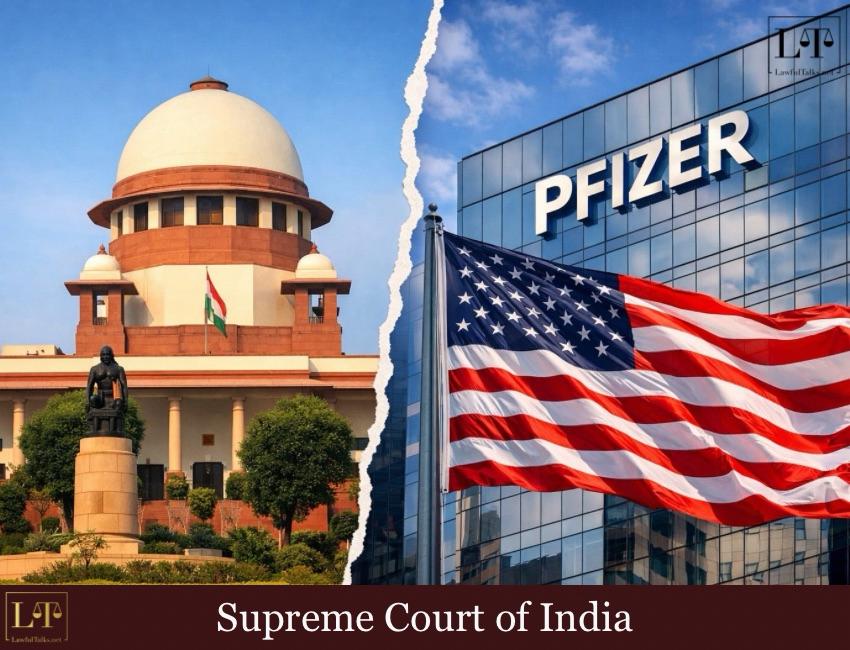

In a hearing marked by sharp criticism and tough questions, a Supreme Court bench comprising Justice Surya Kant, Justice Ujjal Bhuyan, and Justice N. Kotiswar Singh expressed strong displeasure over the lack of regulatory action in the high-profile case involving Indiabulls Housing Finance Ltd., now renamed Sammaan Capital. The matter concerns serious allegations made against the company’s promoters.

At the very outset of the hearing, Justice Surya Kant did not mince words as he criticized the Securities and Exchange Board of India (SEBI) for its apparent reluctance to probe serious charges.

“When question of taking over properties and selling comes, then you say we are the only authority in the country with jurisdiction. But when question of investigation comes? Because your officers have some vested interest? When we are conferring you jurisdiction, [what's the problem?] When we want to give you some authority, why are you reluctant? Every day we see double standards of SEBI! In one of the matters where I constituted a High Powered Committee, your stand was only SEBI has the right to auction the properties. And what you have been auctioning, we know that! 30 crore property, you have sold in few lakhs. When Courts are instructing, you should perform your statutory duty. You say you don’t have power. Why are your officers getting salary if you do not have power?” stated Justice Surya Kant sharply.

The bench also criticised the Central Bureau of Investigation (CBI) for what it called a “cool attitude” in pursuing the case and expressed serious concern over how the Ministry of Corporate Affairs (MCA) compounded nearly 100 violations in just two days. Justice Surya Kant’s frustration was clear when he said:

“Very surprisingly CBI has a very cool kind of attitude and approach in this case. We have never seen such a friendly attitude, as we find in this case. We are sorry to observe like this. This is ultimately public money, it’s not somebody’s private self-earned money that is being circulated. There is strong element of public interest. Even if 10% allegations are correct still there are some large scale transactions which can be dubbed as dubious. Once doubt is created, you register an FIR. It need not be against A person, B person. During investigation, somebody may or may not be found involved. But registering an FIR will strengthen the hands of the ED, SFIO, SEBI. What really prevents the authorities? Why is the MCA indulging in closing the matter like this? What is their interest in this?”

Background:

The case is based on serious allegations, including large-scale illegal activities such as round-tripping, violations of the Companies Act, and siphoning of funds by the promoters of Indiabulls and their subsidiaries. In earlier hearings, the court had noted that the money-laundering allegations seemed credible at least at a preliminary stage. Because of this, the CBI had suggested that the Enforcement Directorate (ED) should be allowed to continue investigating the company’s transactions.

However, no FIR has been registered yet for any basic offence, and this issue continued to remain unresolved. Additional Solicitor General (ASG) SV Raju, representing both the CBI and Serious Fraud Investigation Office, informed the Court that the agencies’ efforts — including filing a petition before a Magistrate under Section 156(3) of the CrPC and contacting the Delhi Police’s Economic Offences Wing (EOW)- had not led to any progress.

Advocate Prashant Bhushan, appearing for the petitioner, urged the Supreme Court to specifically direct the CBI to register an FIR, especially in light of the information disclosed in affidavits filed by the investigating agencies.

Amid these exchanges, Bhushan also recommended setting up a Special Investigation Team comprising experienced officials from CBI, (Serious Fraud Investigation Office) SFIO, ED, and SEBI to thoroughly probe the allegations.

As the hearing progressed, ASG Raju assured the bench that a high-level meeting would soon be convened by the CBI Director with all agency heads. It was at this stage the court realised that SEBI was appearing through a different counsel — not the ASG — and that counsel opposed the idea. This led to Justice Kant’s stern remarks.

Before ending the hearing, the bench directed the CBI to file a new affidavit based on the ED’s intended new complaint. The court also ordered the Delhi Police Commissioner to provide the investigation records related to the ED’s complaint and to explain why no cognizable offense was found.

Case Details: CITIZENS WHISTLE BLOWER FORUM V. UNION OF INDIA, SLP(C) No. 2993/2025

Anam Sayyed

4th Year, Law Student

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 390 Posts

- High Courts 383 Posts