Judge Goes Viral for Savagely Putting Rioters in Their Place

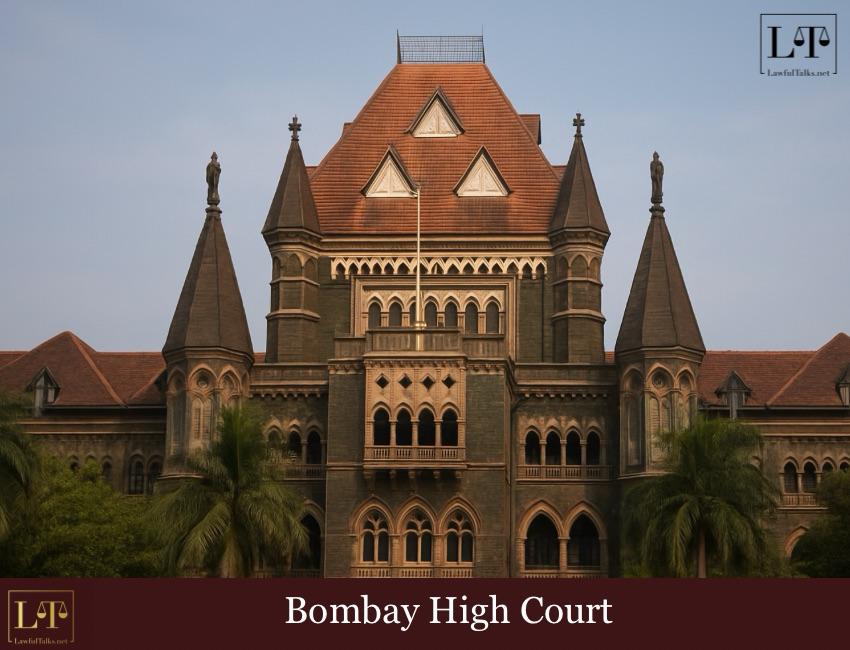

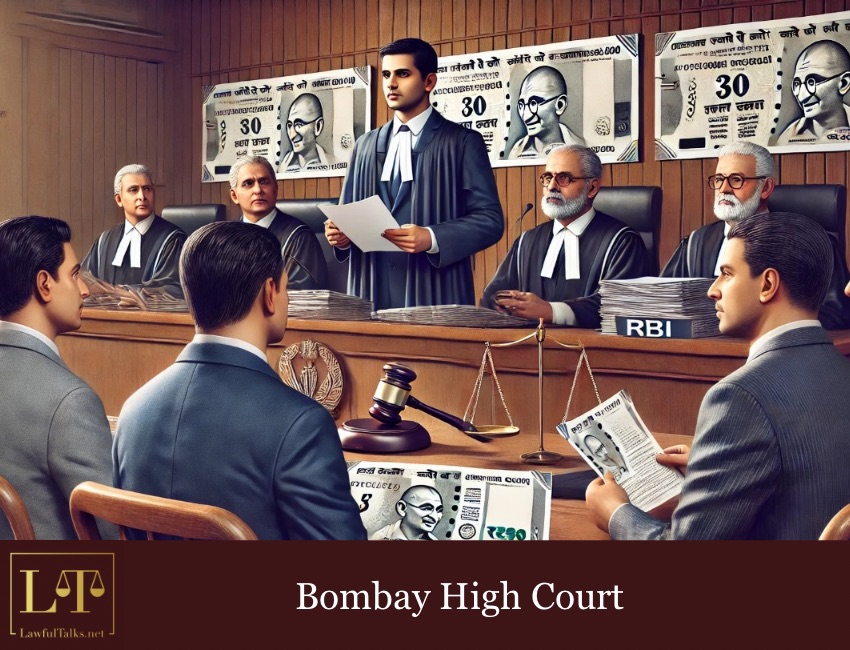

In a recent judgement, the Bombay High Court directed the Reserve Bank of India (RBI) to accept ₹20,00,000 in demonetized currency from the. petitioners. The division bench of Justice A.S. Chandurkar and Justice M.M. Sathaye ruled in favor of the petitioners that they were unable to deposit the amount within the deadline due to circumstances beyond their control.

On November 8, 2016, the Government of India demonetized ₹500 and ₹1,000 currency notes, allowing citizens to deposit these notes in their bank accounts until December 30, 2016. The petitioners, residents of Malkapur, Taluka Shahuwadi, District Kolhapur, collectively held ₹20,00,000 in demonetized currency. However, before they could deposit the money, their residence was raided on December 26, 2016, and the police seized the specified banknotes along with silver ingots worth ₹26,99,320.

Subsequently, the Income Tax Department reviewed the case and, on January 10, 2017, issued a letter stating that it did not intend to seize the cash. Acting on this communication, the police returned the seized currency to the petitioners on January 14, 2017—two weeks after the demonetization deposit deadline had passed. When the petitioners attempted to deposit the amount at the Reserve Bank of India (RBI), Mumbai, their request was denied, citing the expiration of the deadline and the absence of serial numbers for the seized notes.

The petitioners then filed a writ petition before the Bombay High Court, seeking a direction to the RBI to accept the demonetized notes and exchange them for legal tender. They contended that since the money was seized before the December 30, 2016, deadline and remained in police custody beyond that period, it was impossible for them to deposit it within the prescribed time frame.

The Bombay High Court ruled in favor of the petitioners, stating that the delay in depositing the notes was not due to any fault of the petitioners but because the cash was seized by the police before the deposit deadline and remained in their custody until after the deadline, despite the Income Tax Department’s decision not to seize it. The court directed the RBI to accept the specified banknotes from the petitioners and exchange them for legal tender, subject to verification of the serial numbers provided in Annexure-I, which the petitioners had later submitted in an affidavit dated October 24, 2018.

Case Title:Ramesh Potdar vs Union of India 2025 Writ Petition No 2926 of 2017

Advocate For Petitioner: Adv.Udaya Sankar Samudrala

Advocate For Respondent: Adv. D.P. Singh