Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

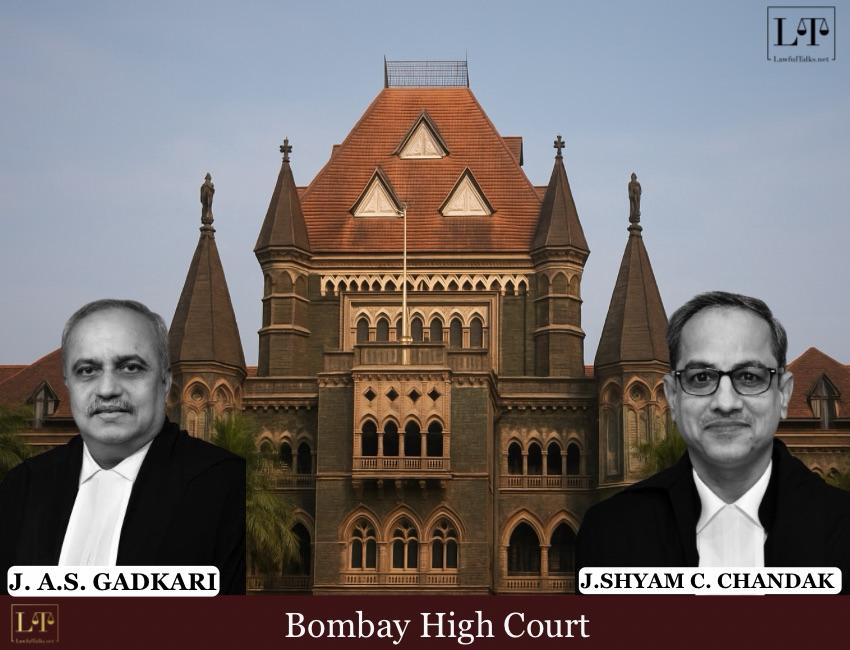

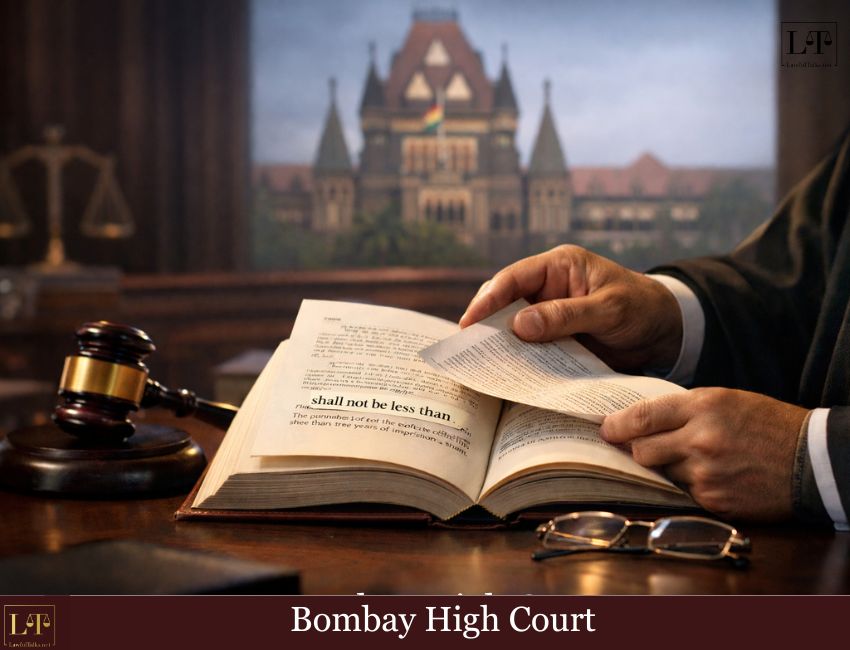

The Bombay High Court has said that a person cannot use the Presidency-Towns Insolvency Act, 1909 to escape or delay paying court-ordered maintenance. The Court made it clear that insolvency proceedings cannot block or weaken a Family Court’s maintenance order in any way.

Facts:

Justice Jitendra Jain delivered the ruling while hearing a husband’s plea to be declared insolvent. The husband said he could not pay ₹22,30,000 in arrears that had built up after a Family Court ordered him to pay his wife ₹25,000 every month. He claimed his monthly income was only ₹12,000–₹15,000 and argued that he met the requirements under Sections 9(1)(f) and 14(1)(a) of the 1909 Act, which he said should allow him to be declared insolvent.

The Court, however, rejected this argument. It pointed out that the Explanation to Section 10 uses the word “may,” which shows that the court has discretion and that a person is not automatically declared insolvent. The judgment states: “Even if a debtor satisfies the requirements on paper, the Court is not bound to declare him insolvent.”

A significant factor weighing against the petitioner was the fact that he had already filed a Criminal Revision Petition challenging the maintenance order, which remained pending. The Court observed that the insolvency petition appeared to be a calculated attempt to avoid compliance, noting that it was “an attempt to stall and circumvent execution proceedings initiated for recovery of maintenance.”

The Court categorically observed: “The Insolvency Act cannot be abused to seek stay of the Family Court order granting maintenance when the petitioner himself has challenged that order in Criminal Revision Petition. Any relief granted in this petition would amount to this Court adjudicating the said Revision Petition, which is not permissible.” The Court added that “the object of the Insolvency Act is not to encourage this course of action.”

The Court explained that Section 14(1)(a) only sets the minimum debt needed to file for insolvency and does not create an automatic right to be declared insolvent. It also said the petitioner could not rely on Section 9(1)(f), which covers general acts of insolvency, because Section 9(2) specifically applies when there is a decree or order to pay money. Since no insolvency notice had been issued under Section 9(2), the Court held that the petitioner could not skip the required legal process.

The Court further noted that the Family Court’s maintenance order was still under challenge, so the claimed debt was not final. It observed that “the sum directed to be paid may undergo a change and therefore cannot be treated as a final debt.”

Accordingly, the Court dismissed the insolvency petition, holding that using insolvency as a shield would weaken maintenance orders and allow people to avoid their legal responsibilities.

Case Title: Mehul Jagdish Trivedi v. Manisha Mehul Trivedi [INSOLVENCY PETITION NO. 01 OF 2025]

Sanika Patil

Third Year BALLB Law Student

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 390 Posts

- High Courts 383 Posts