Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

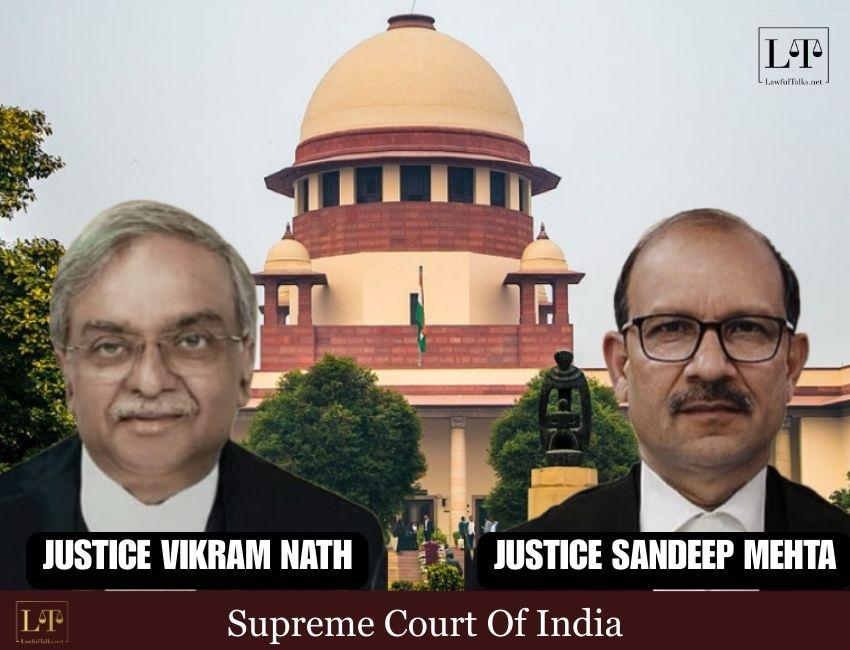

In a major development in a ₹52.5-crore loan fraud case, the Supreme Court has reopened criminal proceedings against M/s Sarvodaya Highways Ltd. and its directors. The Bench, led by Justice Vikram Nath and Justice Sandeep Mehta, made it clear that economic offences cannot be brushed aside merely because the accused have settled their dues with the bank.

The Court overturned a Punjab and Haryana High Court ruling that had quashed the case after the company paid ₹41 crore to the State Bank of Bikaner and Jaipur (now SBI) under a one-time settlement (OTS).

Emphasizing that economic offences affect the public interest far more broadly than just causing financial loss to a bank, the Supreme Court held that repayment—especially when it is much lower than the actual liability—cannot be a shield against prosecution in cases involving forged documents and clear loss to the public exchequer.

Facts:

The case revolves around serious charges under various provisions of the Indian Penal Code—including Sections 120B for criminal conspiracy and 406, 420, 467, 468, 471 concerning breach of trust, cheating, and forgery—as well as offences under the Prevention of Corruption Act, 1988.

The Court reiterated the principle that economic crimes cannot be treated as private disputes that can be settled between parties. It referred to several past rulings and stated:“There are plethora of judgments of this Court, some of which we have referred to above, which categorically hold that in cases involving economic offences, it is not merely the Bank that stands defrauded, but the society at large is also impacted.”

The Court also pointed out that one-time settlements usually do not cover the full amount owed and therefore cannot wipe out the criminal responsibility of those involved in fraud or corruption.

The Bench noted that banks often agree to accept lower amount because they are under pressure or face practical difficulties in recovering non-performing assets Non-Performing Assets (NPAs). It explained,

“One-time settlements are, as a rule, effected under circumstances where the Bank under duress is compelled to accept lesser amount in order to secure the maximum possible recovery against the defaulting account. In this background, we feel that the High Court committed error apparent in the eyes of law by quashing the proceedings.”

The Supreme Court also referred to earlier judgments, including Gian Singh, which “expressly prohibits quashing of proceedings of a criminal case on strength of a compromise where loss to public exchequer is evident and the offences under the PC Act, 1988 are applied.”

During the investigation, authorities found fabricated work orders, manipulated revenue records, and false stock statements that were used to obtain credit facilities. A bank official was also found to have colluded in the fraud.

The account had already been declared a non-performing asset, with an estimated loss of ₹52.5 crore, before the company made its partial repayment under the settlement. The Supreme Court held that the High Court’s decision to quash the FIR and chargesheet, solely because the bank closed its recovery proceedings after the OTS, was legally incorrect.

The Court highlighted that key issues were ignored, including allegations of forgery, charges of corruption, and a recovery shortfall of more than ₹5 crore even after the settlement.

Consequently, the Supreme Court restored the chargesheet and directed the trial court to continue the case based on its merits, while also stating that its observations should not prejudice the accused in any way.

Appearance:

Advocate For Appellant: ASG Vikramjit Banerjee, Senior Advocate Nachiketa Joshi, AOR Mukesh Kumar Maroria, Advocates P.V. Yogeswaran, Merusagar Samantaray, Vishakha, Swati Ghildiyal, Jagdish Chandra

Advocate for Respondent: Senior

Advocate Siddarth Dave, AOR Chritarth Palli, Advocates Agam Aggarwal, Harsheen M Palli, AOR Siddharth Sangal

Case Details: Central Bureau of Investigation v. M/s Sarvodaya Highways Ltd.

Anam Sayyed

4th Year, Law Student

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 347 Posts

- High Courts 362 Posts