Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

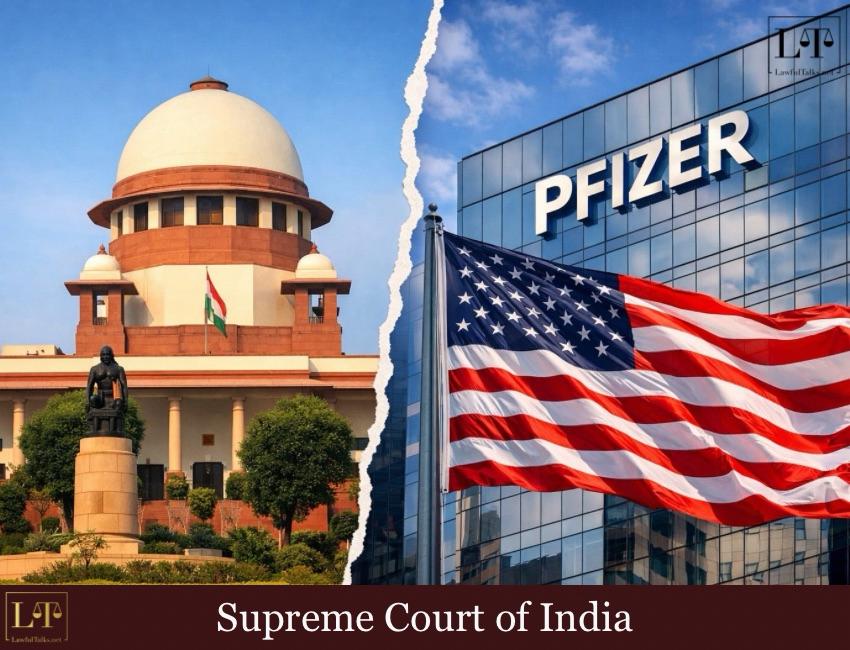

During the hearing of the Anil Dhirubhai Ambani Group (ADAG) bank fraud case, Chief Justice Surya Kant and Justices Joymalya Bagchi and Vipul Pancholi expressed serious concern that bankrupt companies are misusing India’s Insolvency and Bankruptcy Code (IBC) to transfer assets to insiders at very low prices.

Case Background & Counsels’ Arguments:

The bench was hearing a Public Interest Litigation filed by former Union Secretary EAS Sarma, seeking a court-supervised probe into alleged collusion between banks and Anil Dhirubhai Ambani Group (ADAG) companies in an alleged ₹40,000 crore loan scam.

Advocate Prashant Bhushan, appearing for the petitioners, said that Reliance Communications and Reliance Infra had dues of ₹47,000 crore but were sold for only ₹455 crore in insolvency proceedings. He stated it was “1% of the total outstanding amount, and it was sold out to whom? to the brother’s company.”

Senior counsel Mukul Rohatgi, appearing for Anil Ambani, replied that the Insolvency and Bankruptcy Code (IBC) resolutions are still unresolved.

The CJI said the system is being widely misused. He stated:

“Unfortunately, the IBC platform is now being misused like anything, you get the company’s all assets undervalued, then you indulge in a kind of an auction, which is also a completely pre-planned game, somebody from the family or the close friends comes and buys it.”

The Solicitor General agreed and said:

“The Government of India is also seriously considering this issue in the IBC. I cannot say much, I am a part of the discussion, but it is under very serious consideration.”

The Chief Justice added that the Court sees such cases every day. Companies declare bankruptcy voluntarily, their own people value the assets at “not even 10% of the actual market value,” and then sell them to family members or associates. He said:

“Voluntary declarations by the companies (of Bankruptcy), then your own people evaluate you, the evaluation is not even 10% of the actual market value, and then you eventually find out this….everyday Iam observing.”

The Court also criticised the CBI for filing only one FIR in 2025 based on State Bank of India’s complaint and later adding complaints from other banks into the same case, even though each concerned separate transactions.

The bench directed the CBI to investigate whether bank officials were involved in any collusion.

Case Detail: EAS Sarma v. Union of India and others |W.P.(C) No. 1217/2025

Anam Sayyed

4th Year, Law Student

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 356 Posts

- High Courts 369 Posts