Allahabad HC Sets Aside Afzal Ansari's Conviction, Allows Him to Continue as MP

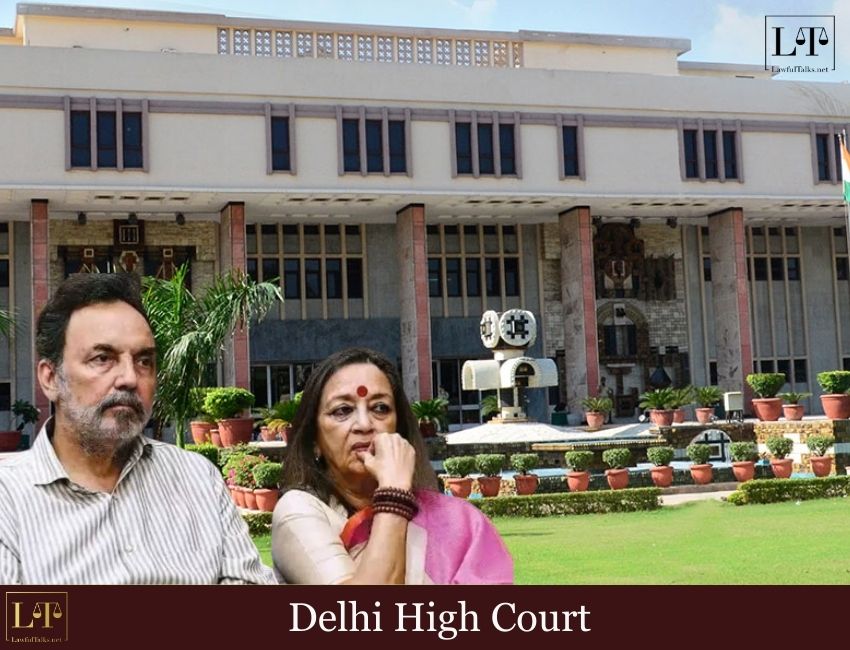

The Delhi High Court has quashed the income tax reassessment notices issued to Dr. Prannoy and Radhika Roy, founders of New Delhi Television Ltd. (also known as NDTV). The notices were in connection to transactions involving RRPR Holding Pvt. Ltd., a promoter of NDTV.

A Division Bench of Justice Dinesh Mehta and Justice Vinod Kumar imposed costs upon the Income Tax Department for the same, holding that the department cannot ‘change their views’ after an earlier reassessment into the same transaction.

Facts:

The petitioners argued that the tax authority had previously reopened the case involving RRPR’s transaction in July 2011, leading to the reassessment order dated March 2013. In November 2017, the petitioners had approached the Delhi High Court, claiming that the above investigation amounted to a second reopening in the same assessment year and therefore constituted an unlawful ‘change in opinion’ under the Income Tax Act, 1961. The petitioners also challenged the assessing officer’s observation that the earlier assessment was limited in scope and this, by itself, justified re-opening the case to re-examine the entire allegedly under-assessed income.

Judgement:

The Division Bench agreed with the petitioners, holding that the department’s attempt to revisit the interest-free loans advanced to RRPR Pvt. Ltd. was improper since the same transactions had already been examined in an earlier assessment cycle. The bench held that the department could not change their views on the same issue after an earlier assessment had already brought conclusive results.

Imposing costs of Rs. 2 lakhs on the department with Rs. 1 lakh to be paid to each of the petitioners, the bench also observed that “No amount of cost can be treated as enough for these cases. However, we cannot leave these cases without imposing any”.

Finally, the bench quashed the original 2016 notices issued to the petitioners, along with any subsequent orders and proceedings arising from them.

Order Awaited.

Case Details: Radhika Roy v. Deputy Commissioner of Income-Tax Circle 18(1) & Anr. (W.P.(C) 10527/2017)

Dr. Prannoy Roy v. Deputy Commissioner of Income-Tax Circle 18(1) & Anr. (W.P.(C) 10529/2017)

Tanaya Damle

2nd Year B.A.L.L.B. Student

Latest Posts

Categories

- International News 19 Posts

- Supreme Court 347 Posts

- High Courts 361 Posts